How to Earn Passive Income via NFTs and DeFi

Earning money with NFTs on BSC and by staking AIRT with juicy APYs on AirNFTs can be very profitable.

April 29, 2022

If you're a cryptocurrency investor, staking is a concept you'll hear about often, but like many crypto concepts, staking can be a complicated or simple idea, depending on how many levels of understanding you're willing to unlock. This guide will cover the basics of staking, how it works, and how you can start earning crypto.

What is Staking?

Staking is part of the process that some cryptocurrencies use to verify transactions. To explain it well, it’s important to have some basic understanding of blockchain transactions. Proof-of-Work (PoW) and Proof-of-Stake (PoS) are two consensus mechanisms used to validate transactions on a blockchain platform.

Proof of Stake vs Proof of Work

Bitcoin, the first blockchain ever created, uses Proof of Work. This consensus, often referred to as "mining," uses hardware to provide node validation and generate new blocks on the blockchain. Because computers must perform these complicated calculations, they tend to cost more, due to the high power consumption. Therefore, mining is not a sustainable system, and not everyone can be a miner on the network.

Proof of Stake, on the other hand, is an alternative to PoW. Instead of mining, and much less energy-intensive, validators stake their crypto using complex algorithms to generate new blocks. Platforms such as AirNFTs prefer staking to mining, as it is much more environmentally friendly. Proof of Stake is one of the most popular for its efficiency and because participants can earn rewards on the crypto they stake.

Staking rewards are an incentive that blockchains offer to participants. Each blockchain has a set amount of crypto rewards for validating a block of transactions. Each time you stake and are chosen to validate transactions, you receive crypto rewards.

What are the benefits of staking crypto?

There are all sorts of benefits to staking cryptocurrencies. Let's look at three:

- The primary benefit of staking is the potential for high returns (interest rates can be very generous depending on the cryptocurrency you stake). It's potentially a very profitable way to invest your money. And, the only thing you need is crypto that uses the proof-of-stake model.

- Staking is also a way to support the blockchain of a cryptocurrency you are invested in. These cryptocurrencies rely on holders staking to verify transactions and ensure that the whole thing works.

- It's more environmentally friendly than mining crypto, which makes AirNFTs also environmentally friendly.

Risks related to staking crypto

The biggest risk you face with staking is that the price will drop. Keep this in mind if you find crypto offering extremely high staking reward rates.

- Crypto prices are volatile and can fall quickly. If the assets you've pledged suffer a sharp drop in price, it could outweigh the interest you earn on those assets.

- Staking may require you to lock in your coins for a minimum period of time. During this time, you cannot do anything with your staked assets, such as sell them.

- When you want to unlock your crypto, there may be an unlocking period of seven days or more.

Although the cryptos you put into play still belong to you, you have to unlock them before you can trade them again. It is important to know if there is a minimum lock-in period and how long the unlocking takes, so you won't have any unpleasant surprises.

How to earn crypto with juicy APY

You can earn crypto with high APY by saving, staking, or taking advantage of promotional offers.

What is APY in Crypto?

The Annual Percentage Yield (APY) acts as a cryptocurrency savings account similar to an Annual Percentage Rate (APR) account. You can deposit your bitcoin (or other crypto asset) and receive a fixed rate of return over a specific period of time. In other words, APY is a method of calculating the amount of money earned on a money market account over the course of a year. It is a technique for tracking the accumulation of interest over time.

The interest you earn on your funds is called compound interest. This is the amount you receive on both the principal amount (the money you put in your account) and the interest that has been earned. Compounding creates money over time, which is why it is such a powerful investment tool.

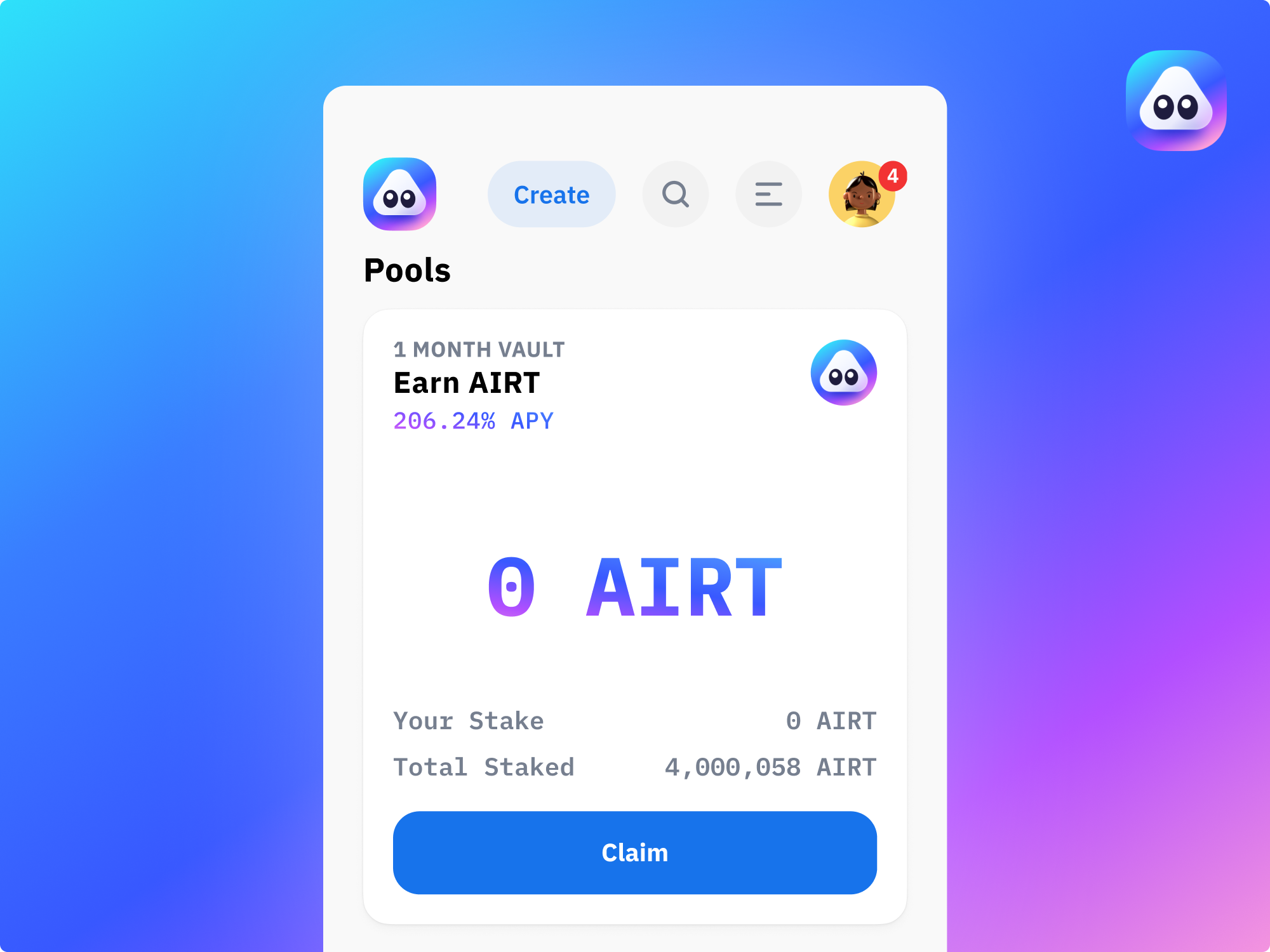

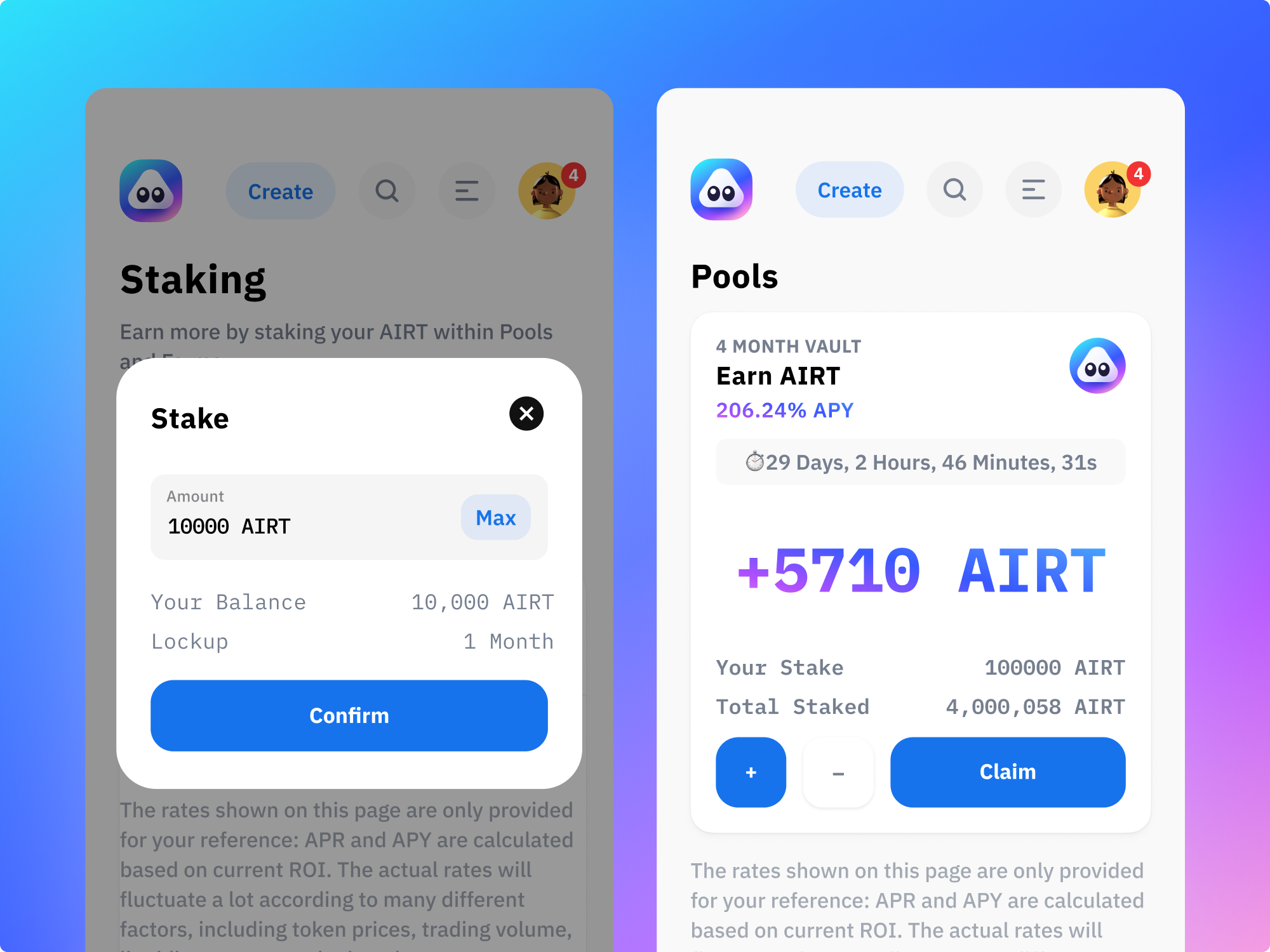

How to Stake AIRT with juicy APY?

- Visit AirNFTs page and buy AIRT.

- Go to AirNFTs Staking page.

- Approve AIRT.

- Start staking and earn passive income.

Note: The lock-up period for staking on AirNFTs is one month (30 days). If you wish to claim your rewards before this time, you will be charged a 10% penalty.

Conclusion

AirNFTs has entered the DeFi (Decentralized Finance) space to offer more options to its users on its NFT marketplace. This will empower more NFT projects to access customized staking services without having to build their own smart contracts, and also earn passive income on BSC via AirNFTs.