The Future of NFTs

Non-fungible tokens have disrupted the digital world and industries from art to gaming, ticketing to blockchain domain names. Find out more with us.

December 23, 2021

Reports highlight that NFT trading volume hit more than US$10 billion in the last quarter. This represents a staggering 38,000% increase over the previous year, and global brands and financial tycoons are paying scrupulous attention. With a number of large-scale, high-profile investments in the technology, it's pretty clear that NFTs are quickly outgrowing their usefulness as digital works of art. They are digital tokens of virtual and real-world assets that can be applied to any item.

As the boom of unique collectibles on social media platforms inevitably fades, the second wave of NFT adoption - already in its infancy - will show that the technology's universal adaptability can have a significant impact on all of our lives.

1. Gaming

Given their familiarity with the concept of alternative currencies and virtual worlds, gamers are an ideal target market for NFTs. NFTs allow in-game items to be tokenized and easily transferred or traded on P2P markets, such as the Binance Smart Chain (BSC). Decentraland is one of the best examples of games that use a blockchain marketplace. It’s permanently owned by its community and gives its players full control over their creations and virtual assets.

Other NFT-based online video games include Sky Mavis' Axie Infinity, a Pokémon-like game that has surpassed 2 million daily active users, and Battle Pets, a blockchain game about adorable pets running on the Binance Smart Chain (BSC). Learn more about Gaming NFT Marketplace here.

2. Ticketing and Transactions

A typical example is event ticketing, where NFTs can help solve a number of problems that event organizers face, such as fraud and ticket resale. NFTs make it easy to verify the authenticity of a ticket and transfer ownership in a secure and seamless manner. The transaction made by purchasing an NFT ticket is stored immutably on the blockchain and is then easily verifiable by the event host. Any secondary sales or unauthorized portfolio transfers can also be easily identified.

3. Changing the music streaming framework

Just like an image or video file, musicians can attach their audio tracks to NFTs and create a collectible piece of music. However, with the decline of physical and digital downloads, music artists depend on streaming revenue, which tends to disproportionately reward middlemen like streaming platforms and record companies. The unequal distribution of income in the music industry is a long-standing issue, and NFTs are an opportunity for artists to regain control of their music through smart contracts embedded in the blockchain underlying NFTs. Learn more about how to create your own music NFTs here.

If you’re a creator, we recommend you visit our marketplace to make your own NFTs. You can mint and sell them to your user base.

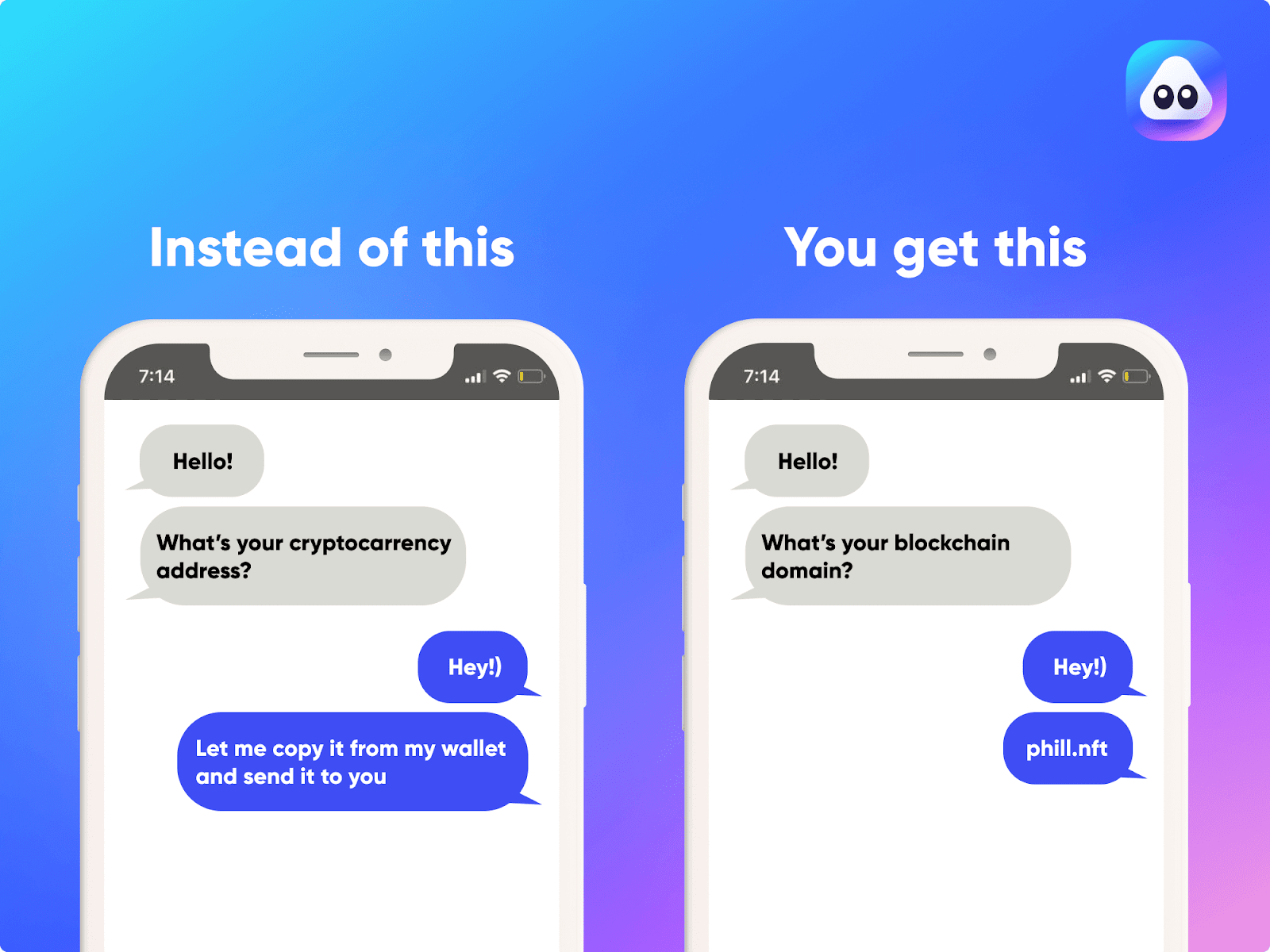

4. Blockchain Domain Names

Yes, it makes sense to have a domain name as an NFT. You can use NFT domains as your universal username across apps and websites, website URL, payment address for wallets, and much more. This type of domain ownership allows you to replace cryptocurrency addresses with a human-readable name. Examples of cryptocurrency platforms that offer this service include Ethereum Name Service (ENS) and Unstoppable Domains. Now, you may be wondering about the benefits of domain names that live on public blockchains.

First, keep in mind that blockchains are decentralized, which has a number of implications. When you purchase, for example, philip.eth or philip.crypto, you own it forever. In other words, you’re buying a Non-Fungible Token (NFT) that lives on the Ethereum blockchain. On the other hand, if you buy philip.com, you’re renting access to the name to an organization that manages lists of domain names on servers it controls. Reason why you have to pay every year to renew a .com domain name. Another advantage is that, since you actually own the NFT/domain name, if you want to transfer the domain name to someone else, you can do so instantly by simply sending the NFT to another address. In the traditional DNS world, you’d have to wait, sometimes for weeks or months, for an intermediary to authorize your transfer.

5. Real-World Assets

We spoke about this in the post “Top Three Reasons Why NFTs are Viable Long Term Assets”, but let’s review.

NFTs can be used to verify ownership of real-world assets such as houses, cars, etc. As with other applications, NFTs can help prevent people from reselling assets that do not belong to them. In other words, you won’t be able to scam ownership. Decentraland is a user-owned, Ethereum-based virtual world that makes it possible to purchase parcels of land on which to build your own environments, marketplaces, and applications. Using NFTs to purchase objects and areas ensures that the original owners are identified.

6. Documentation

NFTs contain unique information stored in their tokens. These tokens can be used to verify documents such as degrees, certifications, driver's licenses, medical records, passports, birth and death certificates, and other qualifications. The main reason is to prevent fraud and streamline verification processes. Blockcerts is an example of a blockchain platform that creates apps that deliver blockchain-based records for academic credentials, professional certifications, and other civic records.

7. Supply Chain

One important positive contribution that NFTs could make to the supply chain and logistics is the accurate traceability and control of a specific item. They ensure that supply chain data remains authentic and reliable, such as its current owner, location, and characteristics such as weight, size, and certifications. This information is updated in the NFT, which remains stored in the blockchain network as the product moves through the supply chain. When items arrive at their destination, a reliable and detailed history of their entire journey from origin to delivery can be accessed. The added benefit is the nature of NFTs to represent unique items.

Conclusion

With many use cases entering the real world and adding tremendous value to people's lives, it’s only a matter of time before we see the mass adoption of NFTs. We’ll see the creators’ economy change as they will have more control over their work and will be able to monetize it in many ways, and guess what? We’ve got you covered. You can monetize your creative works for less than a dollar on AirNFTs. Visit our marketplace today to get started.