NFT Renting Explained

Want to learn more about NFT rental, the best NFT rental marketplaces, and how to rent your own NFTs to earn crypto? Check out this guide.

November 17, 2022

If you've been in the NFT space for a while, you know that buying and collecting NFTs is never cheap. Even the cheapest NFTs from popular NFT projects, such as Cryptopunks or Bored Apes, are not sold at a price the average collector can afford. This is where NFT renting comes in, giving you the benefits of having an NFT (as well as the utilities that come with it) for a limited period without the financial commitment of investing in it. Let’s explore this concept together.

What is NFT renting?

NFT renting is where individuals who do not own or possess a particular NFT but wish to utilize its utility or experience it for a brief time borrow the NFT from a relevant NFT renting protocol.

NFT rental marketplaces use Defi blockchain technologies to facilitate secure transactions and ensure that the NFT returns to its owner at the end of the rental period.

Why would someone rent an NFT?

The answer is simple: to make money. For the lender, NFT renting creates a financial revenue stream by allowing them to earn money passively to use their NFTs.

From the borrower’s standpoint, it opens an opportunity to join the NFT community. In addition, renting NFTs is an inexpensive way to enjoy the benefits of some of the high-end NFT utilities without making a significant initial investment.

On the other hand, some people may only need or want to use an NFT for a specific purpose and time. In this case, renting allows them access to the NFT when needed.

The potential for NFT renting could be enormous. Digital art, metaverse lands, and in-game assets such as characters and weapons are prime candidates for NFT rental. For play-to-earn projects, renting game assets could temporarily allow the player to increase their earning power. An effective rental system could also enable these earnings to be shared with the lender, providing an additional source of passive income.

How does NFT renting work?

There are two main types of NFT renting: Collateral renting and non-collateral or collateral-less renting.

1. Collateral NFT renting

This renting involves a renter or borrower providing collateral to use someone else's NFT temporarily. NFT owners can list their NFTs on an NFT rental platform such as IQ Protocol, and borrowers who like the NFT then initiate the borrowing process, during which the asset goes into an NFT rental smart contract.

To protect the lender's interests, the borrower must deposit collateral of a higher price point than the NFT. The borrower also has to pay a certain sum as a rental fee. After the contract expires, the NFT is returned to the original owner, and the borrower will get their collateral back.

However, there are potential risks with the collateral model:

- The price of the NFT that the borrower pledges as collateral can be just as prohibitive as the purchase price of that NFT community. This can reduce the number of viable borrowers.

- The borrower may decide not to return your NFT. Sure, you have a backup guarantee, but that's not enough of a financial consolation compared to the cost of a stolen digital asset. This is where collateral-less renting comes in.

2. Collateral-less NFT renting

Collateral-less or collateral-free renting follows a similar path to the collateral model and offers significant benefits to both the asset owner and the borrower. The sole difference is that, unlike collateral renting, the renter or borrower doesn’t get the original NFT. Instead, a wrapped NFT with all the exact characteristics of the original asset is minted for them.

Once the contract expires, the wrapped NFT is burned. The renter or borrower does not have to put up any collateral, and the owner or lender does not have to part with their original asset. This minimizes financial risks for both parties.

How to make money renting NFTs?

If you have high-demand or popular digital assets, renting NFTs can help you generate passive income. Also, this concept is trendy if you play NFT "play-to-earn" games because many NFT games require a substantial upfront investment before you can start making money.

One solution would be to buy the NFTs needed for these games and lend them to players who can't afford to buy them but still want to play. In this case, these NFTs would be in-game assets, such as characters or virtual lands, that would give players a competitive advantage during the game. In exchange for renting NFTs, players give you the agreed amount of crypto.

What are the best NFT rental marketplaces where you can rent NFTs?

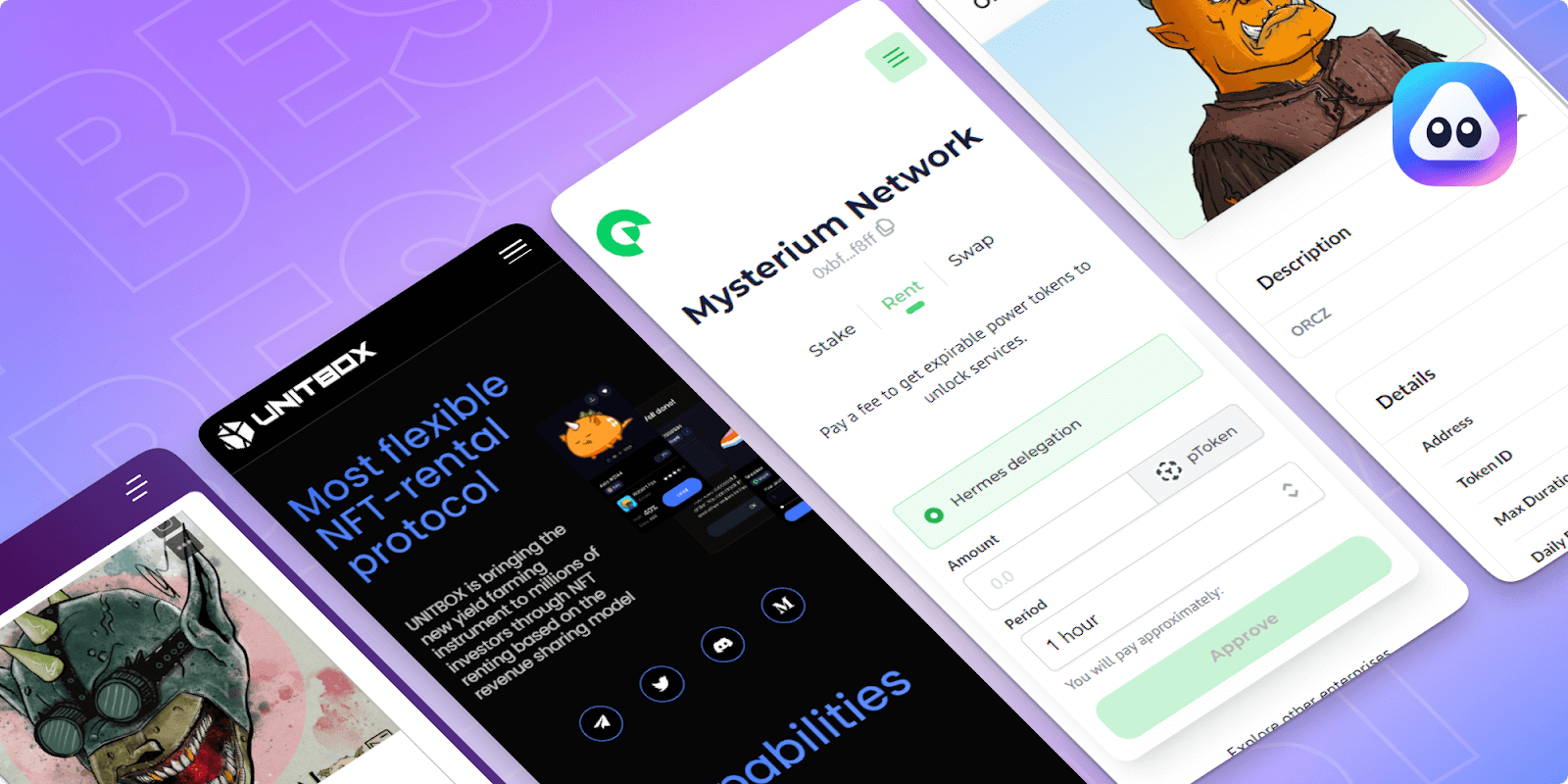

NFT renting platforms to keep an eye on:

- reNFT - multichain NFT rental infrastructure for the metaverse

- UnitBox DAO - NFT rental protocol based on revenue-sharing model

- Vera - multichain Defi protocol for NFT rentals and mortgages

- IQ Protocol - Defi risk-free protocol for NFTs and fungible tokens renting without collateral

- Defy - decentralized multichain protocol that provides NFTs rental, lending, and mortgage

The Takeaway on NFT Renting

NFT rental will only evolve and grow with time, with the demand for NFT rental marketplaces being tied to liquidity and financial use cases. Moreover, NFT renting will empower those wishing to participate in the web3 evolution, whether they own a digital asset or do not have the financial ability to buy them.

At AirNFTs, we want to help you learn as much as possible about the upcoming NFT revolution. While our NFT marketplace does not offer rental services, we offer you a more personalized experience and greater exposure to custom NFTs than copies.

Open our marketplace to explore more, and follow on Twitter for more updates.